Directors’ and Executives’ Liabilities under PRC Company Law (2/4)

Make it stand out

Whatever it is, the way you tell your story online can make all the difference.

(d) Article 125 - Board resolutions violate laws, administrative regulations or shareholders’ resolution and cause damages.

“…Directors shall bear responsibility for the resolutions of the board of directors. If a resolution of the board violates laws, administrative regulations, the company's articles of association, or resolutions of the shareholders' meeting, causing significant losses to the company, the directors participating in the resolution shall be liable for compensation to the company. However, a director who can prove that they expressed dissent during the voting process and had it recorded in the meeting minutes may be exempt from liability.”

According to the second part of Article 125, directors who violate laws, administrative regulations or shareholders’ resolution by board resolution will be held liable. Typical examples will include ratifying or approving actions such as inflating profits in the company's annual report or making false statements in external disclosures. However, dissenting directors who explicitly disagree with or do not subscribe to such violations are exempt from liability. To claim this exemption, directors must bear the burden of proof to demonstrate that they dissented from the action in question.

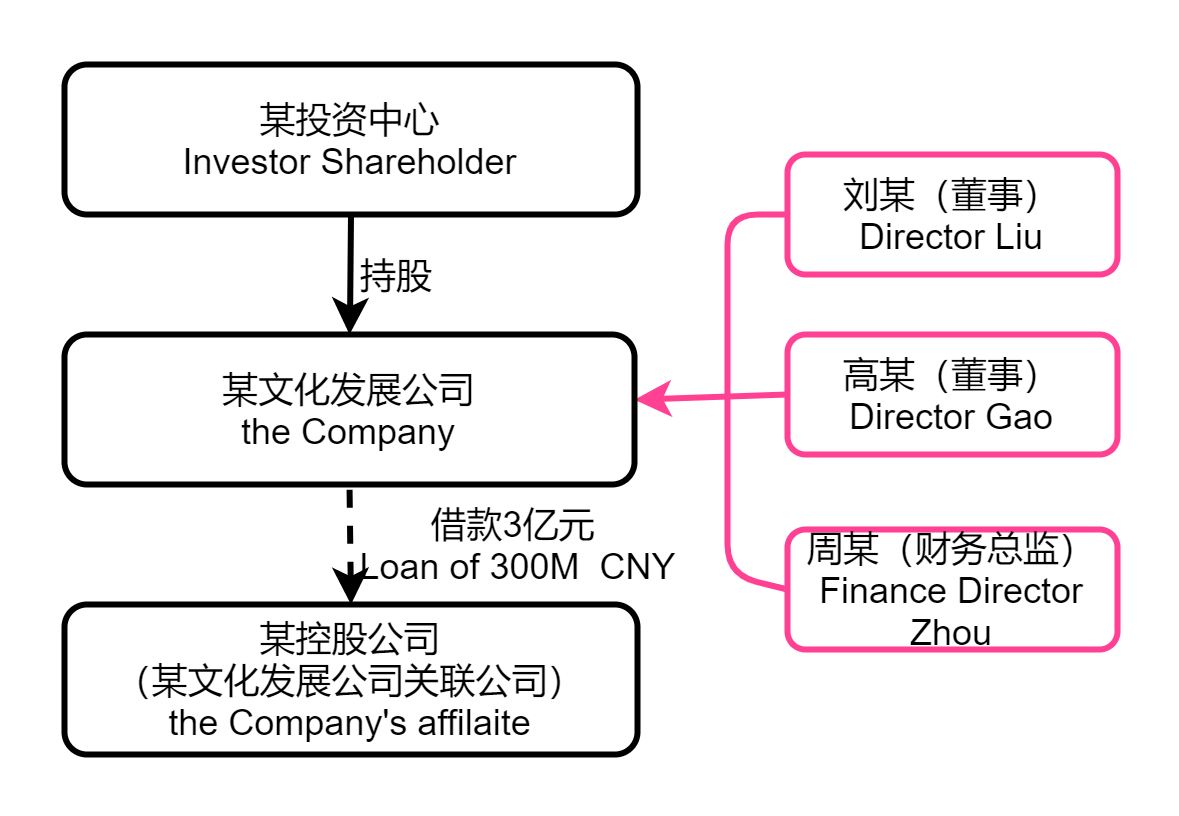

The liability is owed exclusively to the company, not to shareholders or other parties, and the violation must have caused company damages before any liability of the director(s) can be upheld. For example, in the case illustrated on the right, Liu, Gao, and Zhou are directors of the company. In violation of the company's articles of association, they agreed to enter into a loan agreement with the company's affiliate. This decision later caused operational difficulties for the company. As a result, the shareholder filed a lawsuit against the three directors, seeking damages in his capacity as a shareholder.

The directors, however, successfully demonstrated that although they had violated the articles of association, they did not infringe upon the shareholders' rights, including their right to information, voting rights, or right of objection. Furthermore, while the affiliate company was unable to repay the loan, this merely increased the company's liabilities. The shareholders only suffered indirect or collateral damages, and the directors' actions bore no direct causal relationship to the shareholders' losses.

Consequently, the court ruled that the shareholders were not entitled to sue the directors for damages, as they lacked the necessary standing. The court upheld the decision in favor of the directors.

It is also interesting to note, which has not be demonstrated by the case, that the liability owed is of a joint and several nature rather than purely several. This means the company can claim full compensation from any director it considers liable, holding that director responsible for all losses caused by the wrongdoing. The director, in turn, may seek recourse from other directors who were also involved in the decision. Also, this article actually focuses on dissenting directors and not shadow directors (i.e., passive directors). The new PRC company law does include clauses addressing shadow directors, which we will discuss later. Nevertheless, compared to Article 188, which stipulates that directors, supervisors, and senior management personnel who, in the performance of their duties, violate laws, administrative regulations, or the provisions of the company's articles of association, causing losses to the company, shall bear liability for compensation, this article places greater emphasis on the resolution aspect. Specifically, directors cannot use a board resolution as an excuse to claim exemption from liability when the resolution itself violates laws, administrative regulations, the articles of association, or shareholders’ resolutions.

(c) Article 163· Provision of financial support to others

“The company shall not provide gifts, loans, guarantees, or other financial assistance to others for the purpose of acquiring shares of the company or its parent company, except for the implementation of employee stock ownership plans.

For the benefit of the company, with a resolution of the shareholders' meeting or a resolution made by the board of directors in accordance with the company's articles of association or the authorization of the shareholders' meeting, the company may provide financial assistance to others for acquiring shares of the company or its parent company. However, the total cumulative amount of financial assistance shall not exceed 10% of the total issued share capital. Resolutions made by the board of directors must be approved by more than two-thirds of all directors.

If the provisions of the preceding two paragraphs are violated and cause losses to the company, the responsible directors, supervisors, and senior management personnel shall bear liability for compensation.”

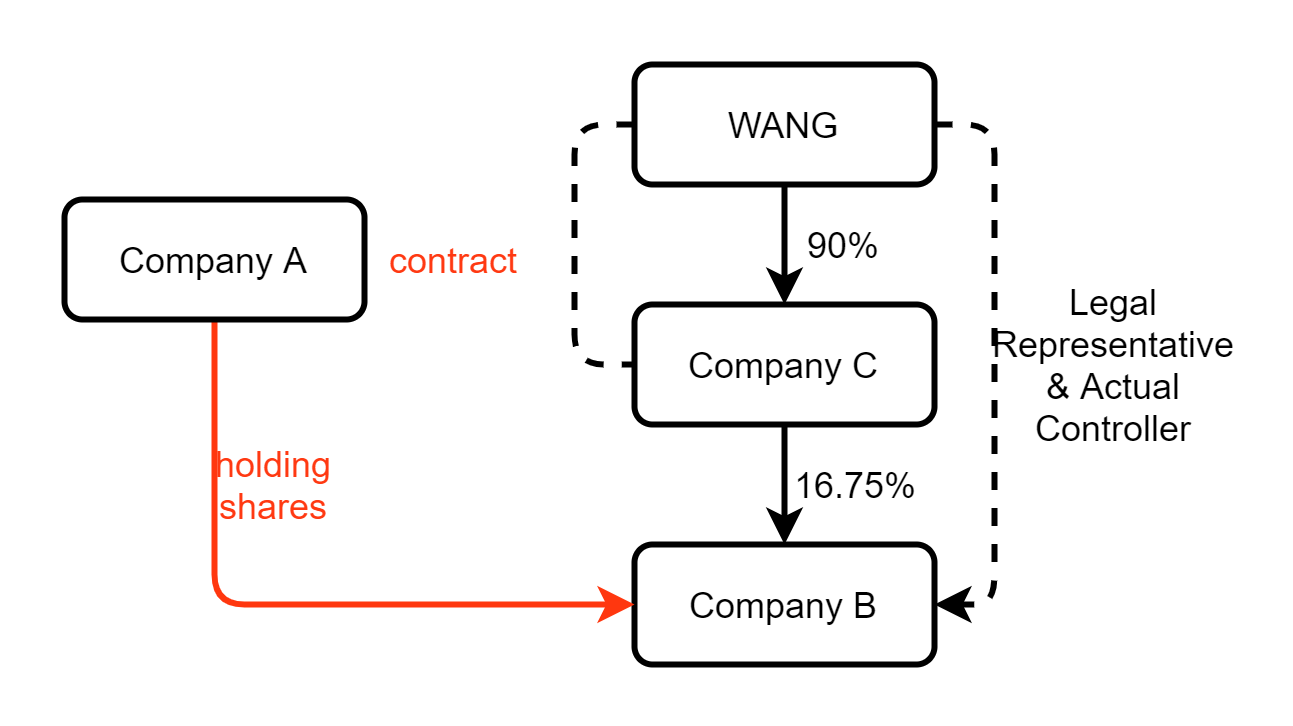

To make an example of how this article operates in practice, the case study on the left is a good read. Company C and WANG voluntarily agreed to provide an undertaking to Company A for subscribing to Company B's shares. In the event that Company A sells or transfers all of its shares in Company B with an annual return rate not exceeding 8.38%, Company C will compensate Company A in cash to ensure the guaranteed return. Later, when Company B's stock price dropped to the margin agreed upon by the parties, Company C and WANG provided some capital and stocks but failed to provide sufficient funds and stocks. As a result, Company A filed a lawsuit against Company C and WANG, demanding that they provide the required funds and pay damages.

The arrangement seems to stabilise Company B’s stock price, which incidentally benefits Company C. Also, it seems to have met the required procedural requirements. The Court found that the contract signed by Company A, Company C, and WANG represents the true intentions of all parties involved and does not violate any mandatory provisions of laws or administrative regulations, making it lawful and valid. The contract stipulates that Company C and WANG shall provide credit enhancement measures for the subscription principal and returns of Company A. This stipulation does not target an unspecified majority of people and essentially reflects the judgment and allocation of investment risks and returns between the shareholders of the target company and the investors, falling within the scope of the parties' autonomy of will. The commitments made by the shareholders and actual controllers of the target company to provide additional credit enhancement funds to the investors are independently subject to corresponding civil liabilities. These commitments do not harm the interests of the target company or its creditors, do not significantly increase risks in the securities market, nor undermine the stability of the securities market. They do not violate the prohibition against guaranteed returns under securities regulations. Therefore, the claims of Company A for the payment of credit enhancement funds and liquidated damages by WANG and Company C are supported.

Despite the stringency of the provisions, the court may be inclined to find some leeway to recognize the validity of agreements if they do not harm the interests of the company or destabilize the stock market.